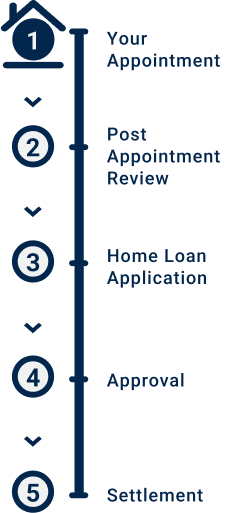

Your Home Loan Journey

Purchasing a property? The team at Welcome Home loans will keep

you up to date and well informed using a clear step by step process.

Your Appointment

Here we’ll discuss your home loan goals, and run you through relevant home loan scenarios.

We’ll also answer fundamental questions such as:

- How far will my deposit get me?

- How much will the banks lend to me?

- How much will my home loan repayments be?

- How do I protect my home loan?

Post Appointment Review

(5-10 min summary video for every customer)

Home Loan Application

We’ll lodge your application for assessment.

Your lodged application is picked up by a bank assessor. It is quite common for assessors to request more information. To name a few, they may ask further questions regarding your income, financial commitments, and bank transactions.

Approval

based on your ability to repay the loan. The lender will issue you with a:

i) Conditional approval (Pre-approval)

A conditional approval requires further conditions

to be met before an unconditional (formal approval)

can be granted.

These are typically:

- Signed Contract of Sale

- Property Valuation

- If required, conditions such as cancelling

credit cards, or paying down debts.

At this stage, you will be confident in your finances, understand your budget, and therefore be able to confidently offer or bid on a property.

i) Conditional approval (Pre-approval)

A conditional approval requires further conditions to be met before an unconditional (formal approval)

can be granted.

These are typically:

• Signed Contract of Sale

• Property Valuation

• If required, conditions such as cancelling credit cards, or paying down debts.

At this stage, you will be confident in your finances, understand your budget, and therefore be able to confidently offer or bid on a property.

ii) Unconditional (Formal approval)

Your offer has been accepted, or you were a

successful bidder at an auction. Congratulations!

- An unconditional approval is granted

once all home loan conditions are met. - An unconditional approval letter guarantees

the lender will fund your home loan.

ii) Unconditional (Formal approval)

Your offer has been accepted, or you were a successful bidder at an auction. Congratulations!

• An unconditional approval is granted

once all home loan conditions are met.

• An unconditional approval letter guarantees

the lender will fund your home loan.

- Settlement

- Settlement

Once settlement has been completed, you can collect

the keys to your new home! Settlement is facilitated

by your property solicitor or conveyancer.